business income tax malaysia

Form BE refers to income assessed under Section 4 b 4 f of the Income Tax Act 1967 ITA 1967 and be completed by individual residents who have income other than business. Total income - tax exemptions and reliefs chargeabletaxable.

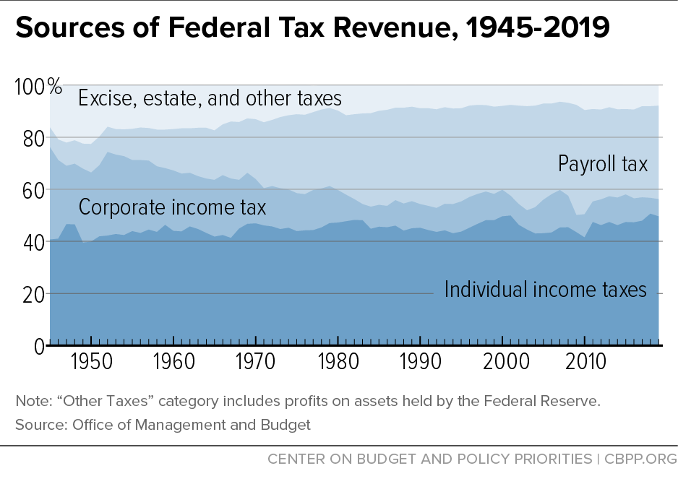

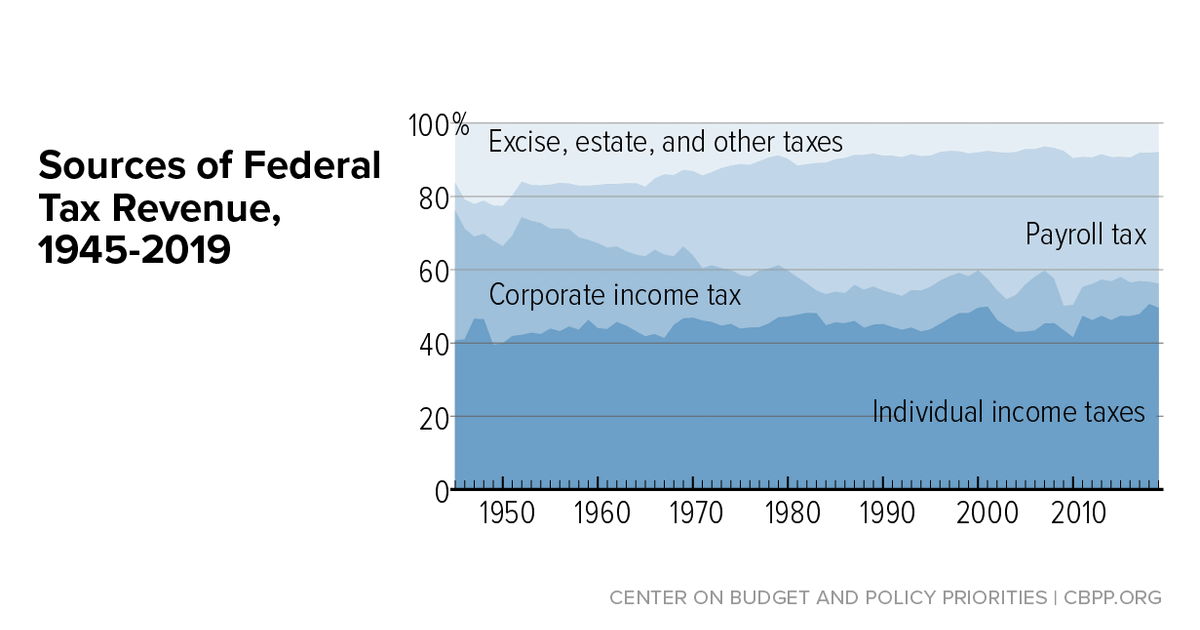

Policy Basics Where Do Federal Tax Revenues Come From Center On Budget And Policy Priorities

Contract payments to non-resident contractors are subject to a total withholding tax of 13 10 for tax payable by the non-resident contractor and 3 for tax payable by the contractors.

. What is the income tax rate in Malaysia. Fines and penalties are generally not deductible. Corporate tax Corporate tax is governed under the Income Tax Act 1967 which applies to all companies registered in Malaysia for chargeable income derived from Malaysia including.

Form BE refers to income assessed under Section 4 b 4 f of the Income Tax Act 1967 ITA 1967 and be completed by individual residents who have income other than business. For example if you want to reduce company tax payable in Malaysia pioneer status firms can. Based on this amount your tax rate is 8 and the total income tax that you must pay amounts to RM1640 RM600 RM1040.

Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. An effective petroleum income tax rate of 25 applies on income from. A corporate tax rate of 17 to 24 is imposed upon resident and non-resident companies on taxable income that is sourced from or obtained in Malaysia.

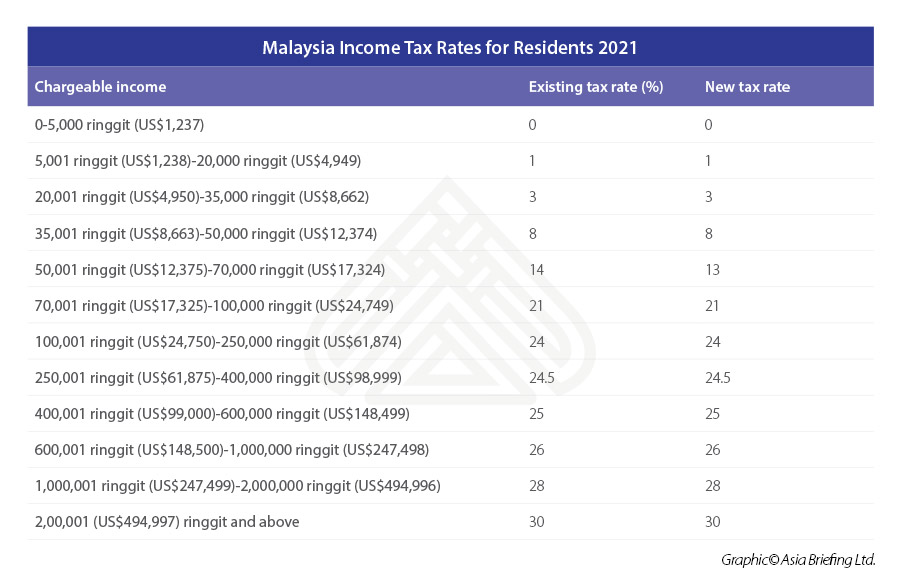

Net Profit below RM 500000 19 Every. The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are. If the first chargeable income of an SME is RM500000 such a company is charged at a rate of 18.

However if you claimed RM13500 in tax. Lists of Business code can. The rental income can be taxed as business income under section 4 a of the ITA Act 1967 if the property owner is comprehensively and actively providing maintenance services or support.

Individuals with business must include the correct business code in the audited report so the financial statement submitted is in line with the scope of business. Resident companies are taxed at the rate of 24 while those with paid-up. Effective from 2018 Year Assessment the corporate taxation rate applies to Malaysian Sdn Bhd companies of a resident status as follows.

Change In Accounting Period. Well look at what exemptions you can for the 2021 tax year shortly but for now this is what you need to know. The business tax Malaysia or company tax for both resident and non-resident companies in Malaysia is 24.

Amending the Income Tax Return Form. The deduction is limited to 10 of the aggregate income of that company for a year of assessment. Basis Period for Company.

Silver Mouse Tax applies to all existing sorts of companies and professions that allow money to be deposited into bank accounts. In case the income exceeds beyond this limit of chargeable income it is charged at a rate. Business or Profession Source.

Businesses can take advantage of a variety of tax incentives and tax exemption schemes. 8 rows Income tax rates.

Everything You Need To Know About How To File Taxes For An Llc In The U S Freshbooks Blog

7 Things To Know About Income Tax Payments In Malaysia

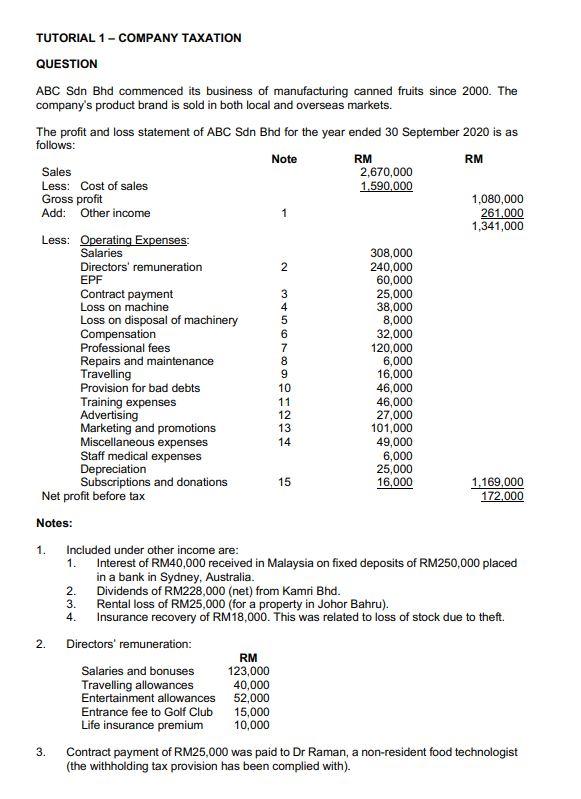

Solution Corporate Tax Studypool

Tutorial 1 Company Taxation Question Abc Sdn Bhd Chegg Com

Micronesia Business Gross Revenue Tax September 2022 Data 2020 2021 Historical

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Policy Basics Where Do Federal Tax Revenues Come From Center On Budget And Policy Priorities

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium

Malaysia Income Tax Rates For Residents 2021 Table Asean Business News

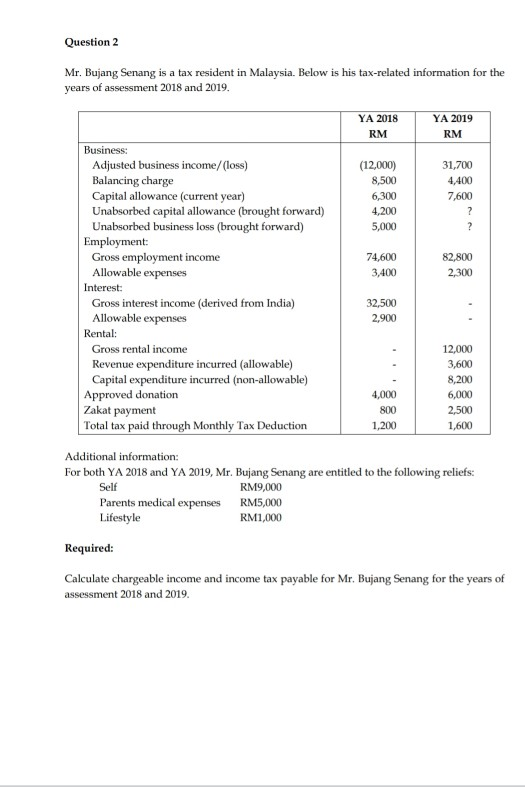

Question 2 Mr Bujang Senang Is A Tax Resident In Chegg Com

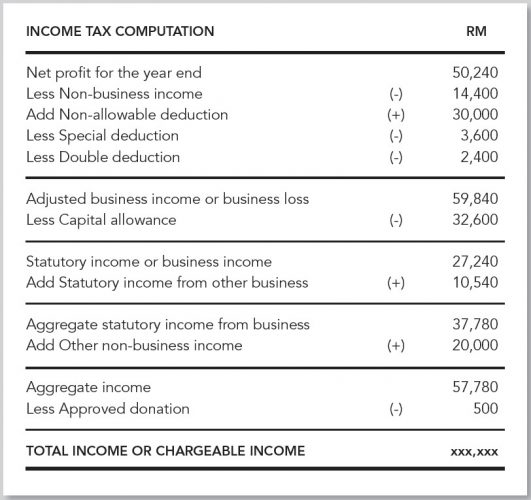

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Expanding The Net Investment Tax Mostly Would Target Households Making 1 Million Or More

Personal Tax Archives Tax Updates Budget Business News

Solution Corporate Tax Studypool

Understanding Tax Smeinfo Portal

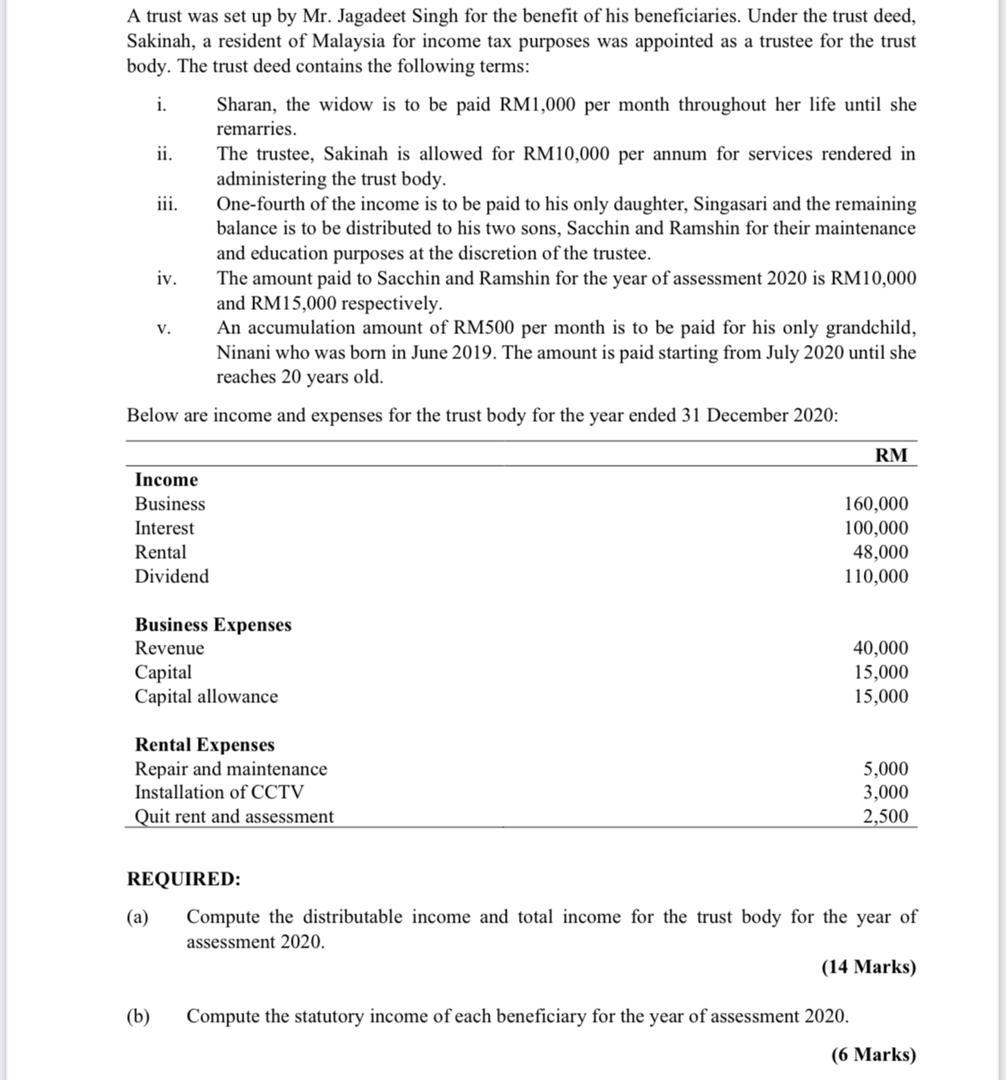

A Trust Was Set Up By Mr Jagadeet Singh For The Chegg Com

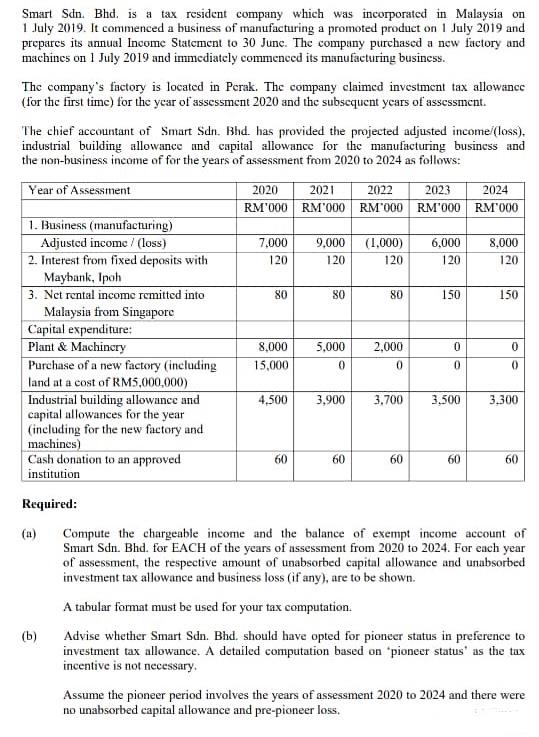

Smart Sdn Bhd Is A Tax Resident Company Which Was Chegg Com

Malaysia Taxation Junior Diary Type 3 Business Income Generate Unit Common Case

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Comments

Post a Comment